The LPA Newsletter February 19, 2013

Dear Fellow Landlord,

Once again, I thank you for supporting The Landlord Protection Agency!

In this newsletter:

- 5 Tenant Problem Recipes to Avoid

- Rental Flow Chart from Pre-screening to Lease Signing

- Paying Rent and Building Credit

- Ask the Attorney, Real Estate Attorney, John Reno

- Wealth Secrets and Quotes for Success

Please e-mail us if you have any questions or would like to add or share any material / information. Have a great month and an even more successful year ahead.

John Nuzzolese

John@theLPA.com

***********************************************

5 Trouble Causing Recipes for a Landlord

Most landlords enter into a rental relationship with a tenant with good intentions and positive expectations. Like a chef who assembles and cooks a gourmet dish, a landlord also must consider the elements of a rental transaction with a tenant and the rental property.

Most landlords enter into a rental relationship with a tenant with good intentions and positive expectations. Like a chef who assembles and cooks a gourmet dish, a landlord also must consider the elements of a rental transaction with a tenant and the rental property.

In order to find a good tenant, we need to first understand the qualities or ingredients that a good tenant is made up from. Once we understand what ingredients we are looking for, we can carefully screen applicants with the right ingredients in mind. The LPA has a few tools that can help you determine if your applicant has the desired qualities you are looking for in your screening process.

So What Are the Trouble Causing Recipes for a Landlord?

-

Not Pre-Screening

If you have lots of free time and enjoy spending countless hours talking with unqualified tenant prospects and then showing them your rental property, taking rental application after rental application, then don't pre-screen your applicants.

If you value your time and prefer to focus only on qualified prospects, you need to have a pre-screening system in place that will allow you to easily weed out the unqualified, while still attracting the better possible tenants.

-

Incomplete Screening / Lack of Credit Report

As a successful landlord, you want to make sure you have done a thorough screening every time you consider accepting a new tenant. If you're like me, your mission is to find something wrong with the applicant. I try my best to disqualify every applicant based on the information on the rental application, past landlord or employment references until I either find something or don't find anything that will eliminate the contestant.

Failing to make a thorough screening check can make you kick yourself later and usually will.

-

Succumbing to pressure and Overlooking Red Flags Often newbie and experienced landlords are pressured to get a unit rented in order to make the payment. We find ourselves rationalizing red flags we recognize as danger signs, only to accept a sub-qualified tenant. You and I know that we may have bought ourselves a little time, but it almost always comes back to bite us... in spades.

Click here for the full article.

***********************************************

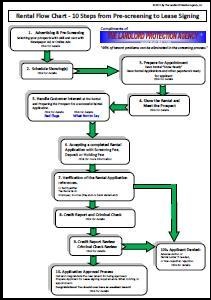

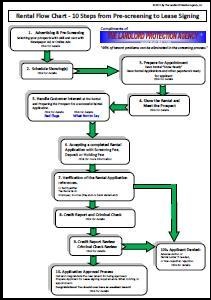

Rental Flow Chart - 10 Steps from Pre-screening to Lease Signing

One common question I am asked is, "Do you have a step by step breakdown of the steps for proper tenant screening?"

Well, now I can say "Yes!"

My new flowchart will walk you by the hand from the moment you place your internet ad or newspaper rental ad through the step by step meeting, showing and tenant screening process right up to the lease signing.

The flowchart bubbles are clickable to pages with more detailed information and links for that stage of the process.

I hope you like it! - John

This landlord flow chart is a simple guide to take you through the steps from first contact with a tenant to signing a rental agreement.

Rental Flow Chart: From Pre-screening to Lease Signing

Rental Flow Chart: From Pre-screening to Lease Signing

***********************************************

Paying Rent and Building Credit

Experian provides renters with an opportunity to build credit history through new collaboration with ClearNow®

Renters of any size or type of residential property can now work with their landlords and ClearNow to report their rental payments to Experian RentBureau

Experian, the leading global information services company, announced that it has extended its capability to accept rental payment data from individual landlords and property managers through its new collaboration with ClearNow®. ClearNow offers a low-cost and easy solution for collecting and making payments electronically and automatically. Experian, through its RentBureau business, currently receives rental payment data from more than 3,000 apartment communities, most of which are managed by large property management companies. Whether a renter lives in a large apartment complex or rents from a landlord that only manages one property, Experian now will provide an opportunity for all renters to build credit history through rental payments.

"We’re thrilled to offer a simple way for many responsible Americans to get the credit they deserve by making their rental payments as agreed," said Steven Wagner, president, Experian Consumer Information Services. "In the past year, we have led the industry in helping renters build credit history, and with the latest collaboration with ClearNow, we are achieving another major milestone."

ClearNow allows landlords and property managers to electronically collect rent from their tenants via an automatic bank account debit. This relationship will allow renters to enjoy the convenience of automating their rent payment, which can help avoid late payments, and opt in to reporting their rent payment history to Experian RentBureau. Experian currently includes rental payments on its credit reports which helps many responsible renters build credit history.

Click here for ClearNow Electronic Rent Collection with Positive and Negative Automatic Reporting to the Credit Bureau

***********************************************

Ask the Attorney

Ask the Attorney

The Landlord Protection Agency® presents John Reno, Esq., a highly experienced Landlord - Tenant attorney based on Long Island, NY. The Landlord Protection Agency® presents John Reno, Esq., a highly experienced Landlord - Tenant attorney based on Long Island, NY.

John Reno also does Mortgage Loan Modifications (Nationwide).

(Mention The LPA for a 10% discount!)

Dear Mr. Reno:

We had a tenant in our mobile home park who passed away. Now we are not getting our rent. She had no will and her children want nothing to do with her mobile home. Someone is now interested in buying her home. How would we go about getting the purchase to go through? Or could we take over ownership of the home in lieu of the rent? The home is in desperate need of repairs so it’s not worth very much?

FYI....we did file a claim with her estate.

Thanks!

Ann Russo, PA

A: If the mobile home is yours, you can take it back, but if the mobile home was hers, it's a problem. The estate now owns it. You need a local mobile home attorney.

If you have a landlord tenant problem you'd like to ask a question about, please feel free to e-mail me your question.

Submit a landlord / tenant question for Mr. Reno

Please try to keep your questions as short and to the point as possible.

Read more from John Reno, Eviction Attorney

***********************************************

FREE Tenant Credit Reporting

(LPA Membership Bonus Feature)

Have you ever been beaten by a tenant on the rent?

Most of us have and unfortunately, it is one of the costs of doing business as a landlord.

On the bright side, remedies are available. If you have documented your tenancy with the proper paperwork including a rental application, lease agreement, late notices, etc., you may have a chance of collecting.

Credit bureau reporting is an option in which many modern landlords are beginning to participate....

Click here for the full article

***********************************************

Wealth Secrets and Quotes

"It's not what you've got, it's what you use that makes a difference." - Zig Ziglar

"Success is how high you bounce when you hit bottom." - General George Patten

"How much did your last tenant problem cost you?" - John Nuzzolese

***********************************************

LPA Membership Expiring?

Take Advantage of our low Renewal Prices!

How to Check your LPA Membership Expiration Date:

- Be logged in with your LPA username & password

- On the "Main Menu" (top right), click on "Your Orders" (right below your name)

- The beginning date of your membership will be listed to the left of your membership order # in this format: YYYYMMDD

*Your Membership Expired? No Problem!

***********************************************

If you haven't already, please take the opportunity to sign up for The LPA's Quick Check Credit Reports! Quick Check is a simple, fast way to access online credit reports while saving you money!

NO sign-up or set-up fees,

NO membership fees,

NO compliance fees

Just lower prices!

Special Tenant Screening Discounts for LPA members.

See our price list!

***********************************************

LPA Members, Interested in past LPA Newsletters?

Feel free to view the LPA Newsletter Archive

What are people saying about The Landlord Protection Agency?

Home |

LPA Membership |

Landlord Q&A Forum |

Free Forms |

Essential Forms |

Credit Reports

|